Delving into Tesla’s Stock Dynamics on Fintechzoom

Pre-Conclusion

Embark on an electrified exploration of Tesla’s stock trajectory on Fintechzoom. This intricate dissection elucidates the driving forces behind TSLA’s performance, prevailing market currents, and anticipations for the titan of electric vehicles’ future.

Introduction

Greetings! If you’re scouring for an incisive perspective on Tesla’s recent market exploits, you’ve stumbled upon a treasure trove! Tesla Inc., perennially at the epicenter of financial headlines, continues to sculpt waves in the fiscal arenas, notably spotlighted on platforms such as Fintechzoom. In today’s brisk financial milieu, where electric vehicles (EVs) are merely a fragment of the broader thrill, Tesla’s stock (TSLA) transcends mere numerics—it encapsulates innovation, controversy, and the transport of tomorrow. Fasten your seatbelt, as we plunge into the currents that energize the fintechzoom TSLA stock in the vibrant universe of green investments and technological wonders.

The Electric Pulse of Tesla’s Market Performance

Market Catalysts: Igniting the Momentum

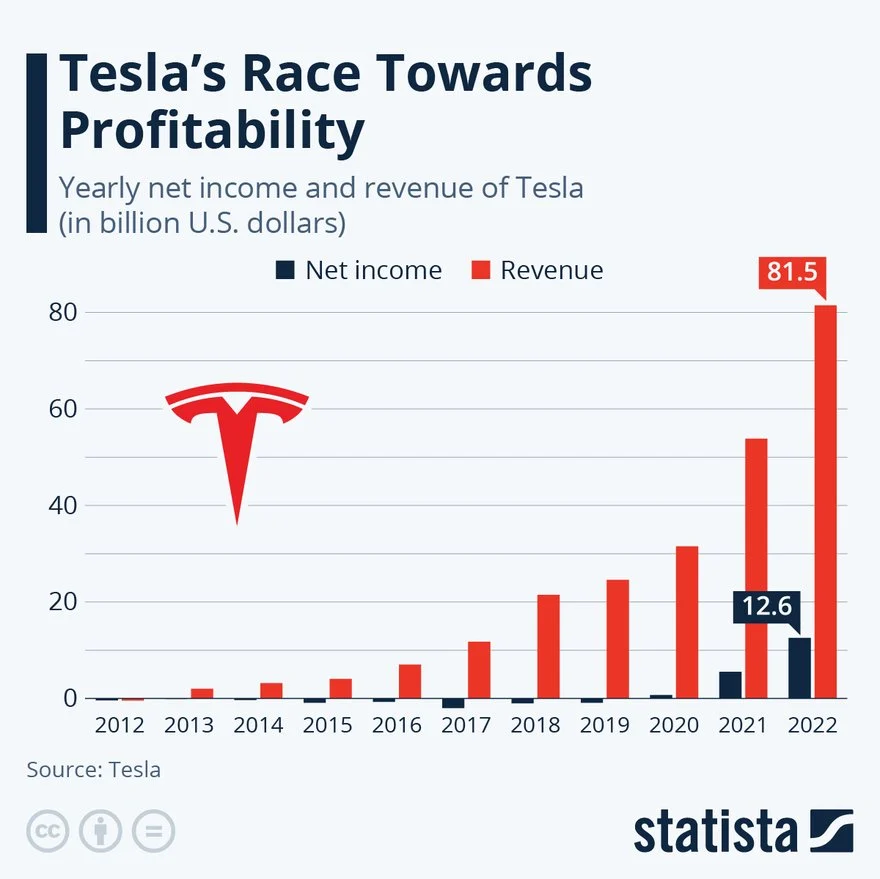

Tesla’s imprint on the stock market is anything but monotonous. Indeed, it resembles a roller coaster, replete with exhilarating ascents and gut-wrenching descents. Whether it’s Elon Musk’s enigmatic tweets that jolt investors into action or pioneering tech unveilings, Tesla’s stock price mirrors a vibrant narrative teeming with risk and ingenuity.

A Dynamic Journey: Navigating the Peaks and Troughs

Embracing Tesla stock is not a pursuit for the timid. The firm’s shares have undergone pronounced volatility, sparked by an amalgam of factors from executive maneuvers to global economic vicissitudes. This erratic trajectory provokes contemplation: What magnetizes investors despite the instability? The answer resides in Tesla’s trailblazing ethos in automotive technology and energy solutions, portending a potentially rewarding venture for those who endure the voyage.

Market Catalysts: Igniting the Momentum

Multiple pivotal elements stir the cauldron for TSLA stock:

- Innovative Product Unveilings: Each announcement of a new model or a leap in battery technology sends tremors across the marketplace.

- Regulatory Shifts: As governments globally champion eco-friendly mandates, Tesla is poised to capitalize from EV incentives and subsidies.

- Economic Indicators: From stock market fluctuations to interest rate trends, broad economic factors significantly mold Tesla’s market trajectory.

Deciphering Fintechzoom’s Impact on TSLA Stock

How Fintechzoom Molds Investor Perspectives

In the digital epoch, platforms like Fintechzoom are indispensable in broadcasting financial data and analysis. They provide instantaneous data, expert opinions, and a wealth of resources that empower both veteran and novice investors to make enlightened decisions. For TSLA stock, Fintechzoom acts as a lens through which digital finance platforms can sway market movements and investor sentiments.

How Fintechzoom Molds Investor Perspectives

Fintechzoom not only chronicles TSLA stock but also sculpts how investors gauge its worth. Through analytical articles, investor forums, and prediction models, it plays a crucial role in crafting the narrative surrounding Tesla’s fiscal health and market potential.

Investor’s Alcove: Strategies for Navigating TSLA Stock

- Research Meticulously: Remain abreast of Tesla’s latest corporate developments.

- Anticipate Volatility: Prepare for fluctuations—it’s inherent in the Tesla experience!

- Diversify Your Portfolio: Avoid placing all your investments in one basket, tempting though Tesla may be.

Frequently Posed Queries

- Why is TSLA stock so volatile? TSLA’s volatility can be attributed to market reactions to corporate news, Elon Musk’s declarations, and shifts in technology and policy impacting the EV sphere.

- How does Fintechzoom influence the perception of TSLA stock? Fintechzoom serves as a pulse for investor sentiment and market trends, frequently magnifying the public and financial reactions to Tesla’s corporate maneuvers.

- Is investing in Tesla a prudent long-term strategy? While Tesla offers potential for substantial returns, investment decisions should align with individual fiscal objectives and risk appetites.

Conclusion

Venturing into the fintechzoom TSLA stock is akin to strapping into one of Tesla’s avant-garde EVs—thrilling, unpredictable, and forward-looking. With its amalgam of cutting-edge technology and potent market presence, Tesla remains an enthralling subject for investors and analysts on Fintechzoom. Whether you’re a seasoned investor or a curious observer, maintaining a vigilant eye on Tesla’s market trajectory promises insights and excitement in the perpetually evolving arena of investments.